3 Ways an Experienced Technology Services Partner Can Make a Commercial Insurance Agency More Prosperous

In some ways, commercial insurance companies are like other businesses, always looking for new ways to become more efficient and more profitable. Reliable technology that’s better aligned with your business strategy is an ideal starting point for achieving these goals, as it can make claim information easier to store and access, freeing staff to concentrate on more important tasks. IT is a solid foundation for better internal teamwork and can help agencies provide a better experience to their clients too.

In order to better manage their technology, insurance agencies often enlist the help of a Managed IT Services Provider (MITSP or just MSP), like Astute Technology Management, to help them monitor and maintain their networks. The benefits that a high-quality managed service provider offers are numerous, and include:

- Predictable pricing with unlimited support

- Proactive network support to maintain peak productivity

- Strategic support to help guide your technology investment

Agencies that are looking to maximize the benefit of their technology investment will want to address other technology problems as well — ones that are specific to the commercial insurance industry. These areas may be more difficult to address, as they require skilled internal IT staff-members or a partner that deeply understands the insurance industry, but they also provide areas for significant productivity gains.

In our two decades of serving commercial insurance agencies, we’ve noticed a few key challenges that agencies in the greater Columbus, Ohio region consistently struggle with, areas in which we’re confident that a good technology service provider could make an important difference.

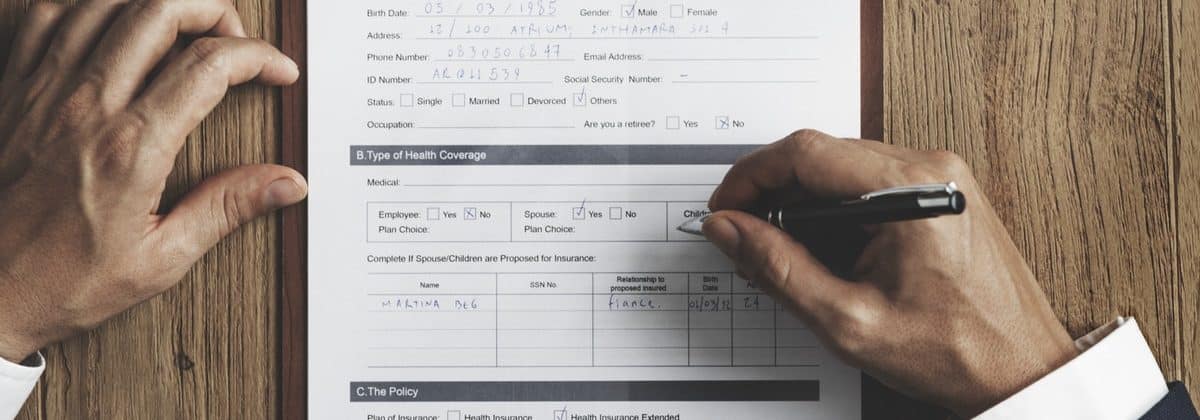

Realizing the Promise of the Paperless Office

There are many reasons to move toward a paperless office. According to a report by the McKinsey group, the workforce of an average insurance agency spends upward of 50% of their time collecting and processing data. Many of those manual processes are ripe for transfer to a digital platform, which can provide an immediate increase in claim and underwriting efficiency. In some cases, processes can be automated entirely, providing even greater productivity gains.

Though there are several document management systems designed to help insurance agencies with the storing, retrieving, and sending of statements, many agencies are hesitant to adopt them. Why is that? Honestly, it can be a daunting and costly transition to digital operations when faced with several hurdles, many of them technical. These range from the basics, such as finding the right scanners and software for each of your documents, to more arcane topics, like ensuring that the newly digitized documents are archived in a logical, intuitive way.

To help make the transition smooth, you should begin by examining your work processes and auditing your technology to see which systems are ready for a paperless transition. Perform this evaluation with a thorough attention to detail, looking at big-picture considerations like cybersecurity and compliance, as well as small details like filename conventions and the scanning processes. Only by considering each aspect can you ensure proper communication with your carrier and your clients, while realizing the full benefit of the paperless transition (without wasting time and money).

Agencies Must Reach for Better Security and Compliance

Along with finance and healthcare, the insurance industry is saddled with particularly heavy regulatory burden. Depending on the area of business your agency is involved, you may be dealing with regulations from the Ohio Department of Insurance, FINRA, and the SEC, each of which have clear guidelines about controlling data access, reporting cybersecurity breaches, and disaster recovery requirements.

According to a report by KPMG, while 42% of insurance agency CEOs acknowledge that the threat of cyberattack is growing, just 20% report being ready for a cybersecurity event. This lack of preparedness comes despite dealing with risk on a daily basis. Whether an insurance agency has decided on a fully-digital transformation, or just wants to ensure that its existing digital assets are protected, it’s crucial that your cybersecurity posture is ready to truly defend your agency.

Don’t allow your cyber defenses to hurt firm efficiency either, though. Cybersecurity platforms are notoriously fickle, and if not properly managed can cause incompatibilities and productivity-killing errors. Worse yet, they may leave holes in your cyber defenses. You may find that working with a technology partner who can design and manage a comprehensive cybersecurity strategy for you is the best way to meet your security needs and ensure full regulatory compliance.

Cloud and Mobile Technology Boost Agent Productivity

There is enormous potential to use cloud and mobile technologies in the insurance industry. Cloud computing can open new areas of opportunity for insurers to create and deliver their products and services, while also better managing their value chains and assessing risk.

Mobile technology has similar potential. While on one hand, insurance agencies are following the general trend toward greater mobility — more hours worked from outside the office, better connectivity from the road — there are several areas specific to the commercial insurance industry where mobile technology can play an important role as well, such providing instant insurance quotes and simplifying the processing of claims. There are mobile applications with document management and e-signatures capabilities as well, further reducing paperwork and increasing efficiency.

Although the potentials for cloud and mobile technology in the insurance industry are great, so are the challenges. Both present infrastructure problems that are virtually impossible for an agency to handle on its own — especially when or if they’re attempting to manage their existing IT and compliance issues without expert assistance.

Beyond the technical needs, cloud and mobile computing also present operational challenges. How do you ensure a unified mobile experience for each staff member across each device or platform? When critical applications are offloaded to remote servers, what’s the best way to ensure that staff are using them in the right way, so that efficiency doesn’t come at the cost of security and uptime? For agencies that don’t have in-house expertise in these two areas — which is most of them — consulting an experienced technology expert to help with projects of this size and importance provides a smoother process and much greater peace of mind.

Astute Technology Management – Trusted IT Partner to the Insurance Industry

More agile, more efficient, more profitable – these are just a few of the ways that technology is reshaping the insurance industry. To make the most of the such beneficial disruptions, we advise that insurance agencies partner with a technology services provider who truly understands their needs and potential, like Astute Technology Management. We have decades of experience serving commercial insurance agencies and offer our clients all the knowledge and resources we’ve gathered in that time.

Are you a commercial insurance agency that’s looking for an IT service provider who truly understands your needs? Contact us any time! We’re happy to talk with companies and answer any questions they may have.